Moments in time

ING: banking pioneers in Russia

ING entered the Russian market in 1994. Within less than twenty years it has become one of the most experienced foreign banks in the country. But it enjoys even longer historical associations through its predecessor businesses, the most important being Barings, which was acquired by ING in 1995. This bank's ties with Russia date back well over two centuries.

Established in London in 1762, Barings rapidly emerged as the world's leading merchant bank. The firm undertook prestigious transactions worldwide and the first account of a Russian client was opened in 1775. From the eighteenth century Barings also financed Russian trade. As merchants, the firm traded in a wide variety of Russian goods through the ports of St Petersburg and Rostov. Timber was of special importance but hemp, tallow, flax, hides, linseed and grain also figured.

Barings also acted as an agent for merchants based in the international markets. This merchant function was soon complemented by banking. As bankers Barings started providing merchants and other clients with acceptance credits and advances. These were used to finance the production of timber products and other commodities for export from Russia to the UK.

Working for government and businesses

From as early as 1817 Barings marketed Russian government bonds internationally. Barings joined forces with Amsterdam bankers Hope & Co and together they marketed small batches of government bonds in both London and Amsterdam. The involvement of the Dutch bank was vital because of the long-standing enthusiasm of Dutch investors for Russian securities. Furthermore Amsterdam bankers were widely recognised for their expertise in issuing them.

Barings' association with Russia was stepped up in the 1850s with the firm's appointment as financial agent in London for the Imperial Russian government. From then on Barings maintained the government's bank accounts in London, undertaking a wide range of banking functions. This appointment as financial agent coincided with major growth in bond issues by the Russian government and later by Russian businesses in the international markets.

Financing railways and tramways

From the mid-nineteenth century another association developed through the provision of finance for the construction of Russia's first railways. This new transportation system formed the keystone of a modern industrialising economy. Railways were, however, vastly expensive to build and could often only be financed by borrowing in the international markets. This was achieved through issues of Russian government bonds, the proceeds of which were lent on to railway companies. Or through the issue of government-guaranteed bonds by the railway companies. Barings was first involved in financing Russia's railways in 1850. Bonds were issued to finance the construction of part of the St Petersburg to Moscow Railway. From 1857 Barings became involved in a massive scheme to finance the construction of over 1,000 miles of railway line to create Russia's first railway network. Barings was also involved in the financing of the development of the city of Moscow. In 1908 the firm led a bond issue to finance various projects including the construction of tramways. Barings' association  with Imperial Russia ended with the Russian Revolution in 1917. The Imperial Russian government's accounts in Barings' books were then frozen and remained so until 1986 when the British and Sovjet governments reached agreement on the settlement of mutual claims.

with Imperial Russia ended with the Russian Revolution in 1917. The Imperial Russian government's accounts in Barings' books were then frozen and remained so until 1986 when the British and Sovjet governments reached agreement on the settlement of mutual claims.

Expertise in emerging markets

The 1990s marked the start of a new era with the fall of the Berlin Wall. Not only for the countries in Eastern Europe, but also in the banking business. ING continued as a single entity in 1990 when the legal restrictions on mergers between insurers and banks were lifted in the Netherlands. This prompted insurance company Nationale-Nederlanden and banking company NMB Postbank Groep to enter into negotiations and eventually merge into Internationale Nederlanden Groep (ING) took place in 1991.

From that moment ING developed to a strong multinational bank through a combination of organic growth and various acquisitions. ING opened its own office in Russia in 1994. And in 1995 it took over Barings Bank. This acquisition increased the brand recognition of ING around the world. Ever since ING has consistently strengthened its position as a corporate an investment bank in Russia with a focus on multinational and blue chip companies. ING survived the Russian crisis of 1998 because of its stable and resilient core business. The corporate lending portfolio suffered barely any losses during the crisis.

Today ING is highly regarded for its expertise in emerging markets in Eastern Europe. It has offices in Russia, Bulgaria, the Czech Republic, Hungary, Kazakhstan, Poland, Romania, Slovakia and Ukraine. The bank offers a wide range of financial services, with its main focus on cash management, financial markets, lending and structured finance. .

Prospectus for the issue of Russian railway shares with map, 1857

This prospectus relates to Barings involvement in financing the construction of 100 miles of railway radiating from St Petersburg.

Director's railway token, 1858

The token was given to Thomas Baring by the Grande Société des Chemins de Fer Russes. Thomas Baring was a Director of that company and the token afforded him free travel on their lines.

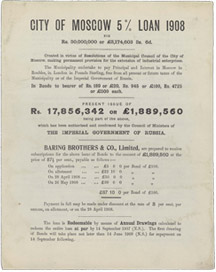

Prospectus for the City of Moscow Loan, 1908

The prospectus relate to the 5% loan of 1908, funds from which were used (among other things) to finance five infrastructure projects including the construction of municipal electric tramways.

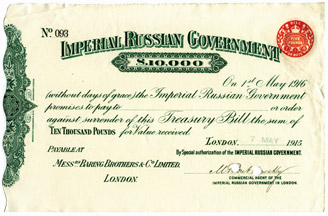

Imperial Russian Sterling Treasury Bill, 1915

These were issued through Barings during the First World War. The proceeds were used to finance Russia's purchase of munitions in foreign countries.